Kemiex Market Insights: Anti-dumping reshaping trade flows (EU)

The EU implemented preliminary anti-dumping duties on Chinese imports of Lysine in mid January 2025, with definitive rates imposed in July 2025 . This probe drastically changed the trade flows and supplier market shares for EU Lysine HCl imports.

The Lysine definitive rates range from 47.7% (Meihua), 53.1% (BBCA, CJ Liaocheng, Dongxiao, Fufeng) up to 58.2% (Eppen, other), while the sole EU domestic producer of Lysine is Eurolysine. The measures effectively priced Chinese Lysine out ofthe EU market.

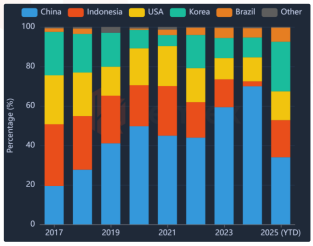

China’s market share of EU Lysine HCl imports had risen from 19% in 2017 to 70% by 2024, however, since the investigation, China’s position has weakened sharply. Its share has halved to just 34% in 9M 2025, with EU imports from China down -60% or -143’000mt YoY.

Korean suppliers CJ and Daesang emerged as winners, with EU imports from Korea more than doubling and those from Indonesia increasing

fivefold . Pending AD and CVD investigations in the US and Brazil may lead to additional global volatility within the next months and year.

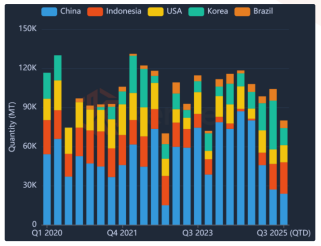

EU Lysine HCl imports main partners

EU Lysine HCl imports market shares

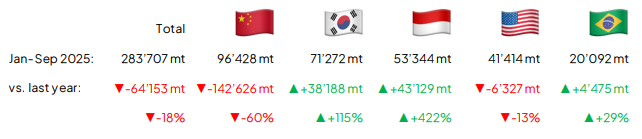

EU: Lysine imports by main trade partners

More analytics for +170 products in Trade Flows

E-procurement for raw materials:

Through Market Radar and the Private Portal, Kemiex provides real-time insights to optimize procurement and maximize efficiency.

Users benefit from:

- Centralized, data-driven decision making

- Real-time updates on global trade flows, pricing, and supply dynamics

- Actionable intelligence for key ingredients like amino acids, vitamins, and feed additives

With over 9,000 users across 95+ countries, Kemiex empowers the global ingredients industry to make smarter, faster decisions in a volatile market.

Get the full insights! Contact us to receive the complete report, including detailed charts and in-depth analysis.