ICIS Top 100 Chemical Distributors - Special Report: Digital Revolution for Distribution?

Discover how digital solutions are reshaping chemical distributors. Stay ahead with insights, strategies, and KEMIEX’s specialized support.

KEMIEX is featured as a leading trade solution for life sciences raw materials in widely known annual “Top 100 Chemical Distributors” special report by ICIS, the world’s largest petrochemical, fertilizer and energy market information provider.

Guenther Eberhard, Managing Director of DistriConsult, presents the results of the latest survey among executives of 200 leading chemical distribution companies and provides one of the most comprehensive recent analysis on the impact of digitisation to distributors:

ICIS Top 100 Chemical Distributors – Digital revolution for distribution?

ICIS Website

.

Links:

Links:

At KEMIEX, we are regularly approached by some of the leading (private) equity investors globally who seek guidance on their USD 50m+ investment decisions for chemical distributors & manufacturers with a special interest in the impact of digitalisation.

Our views we share with them:

- Fast evolution, not revolution: digital is enhancing certain sales and purchasing channels at a fast pace, but it won’t replace the need for intermediaries or physical presences in many areas

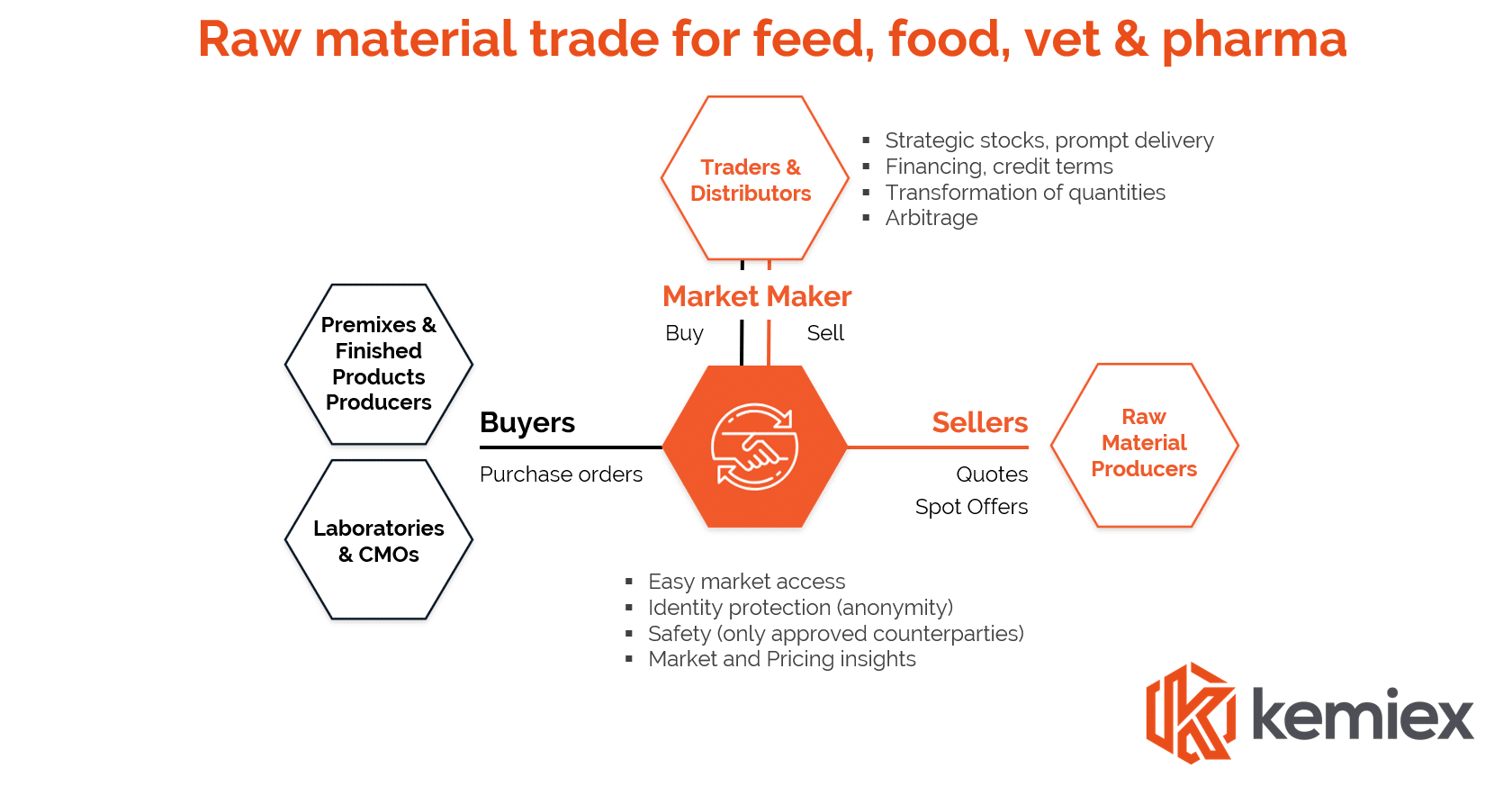

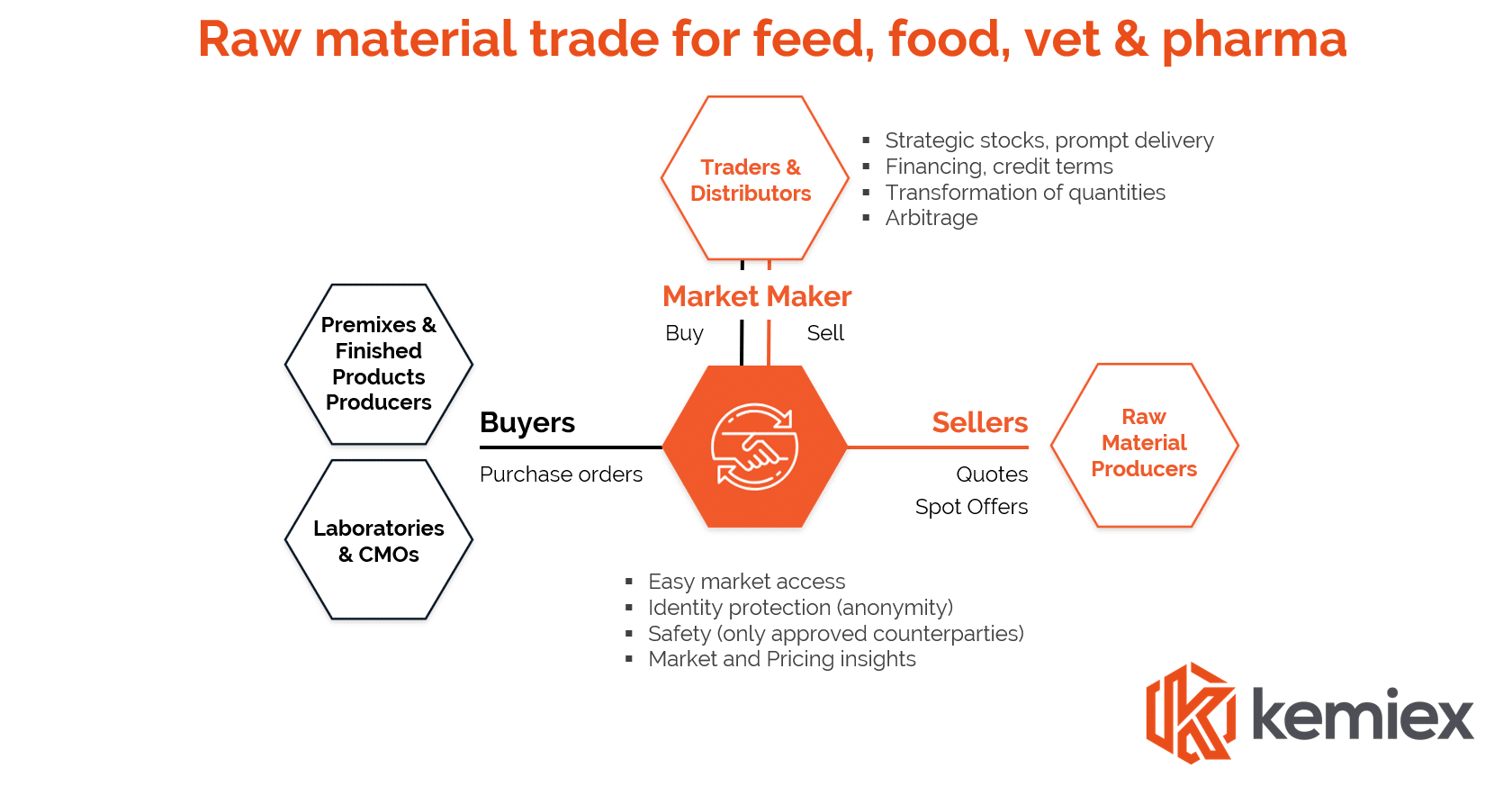

- Buyer and manufacturer driven change: digital solutions help solving issues for buyers such as (1) product availability & specifications (2) convenience & speed (3) price efficiency (4) trade risk management, as well as empowering manufacturers to expand their reach

- Many solutions, not one: a comprehensive multi-e-channel strategy & platform selection is needed to account for different client segments, countries and products

- Focus on business models, not only product innovation: testing and learning from digital channels is fairly cost-efficient, but a culture of innovation and accountability must be implemented by senior management to allow exploring the opportunities and risks

- Busy with basics: many distributors struggle with creating a basic (global) digital presence such as website and/or CRM, using specialized platforms seems utopian

- Winner takes it all: there are low odds of a disruptive “1990s bookstore” or “One Chemazon”-scenario for an overall attractive, growing chemical distribution industry. However, complacent and slow companies will face pressure from their more agile traditional competitors, pushing the laggards to experience their own “General Electric” moment.

- The US$ 1m question: what will be the ultimate market share of “digital distribution channels”? (a) 5% (b) 20% (c) 50% (d) more

At KEMIEX, one of the few independent and specialized networks, we mostly work with highly transactional and professional trading firms who play a very important role now and even more in a digitalised future.

Links:

Links: