Atradius and Kemiex expand trade insurance for digital platforms to +130 countries

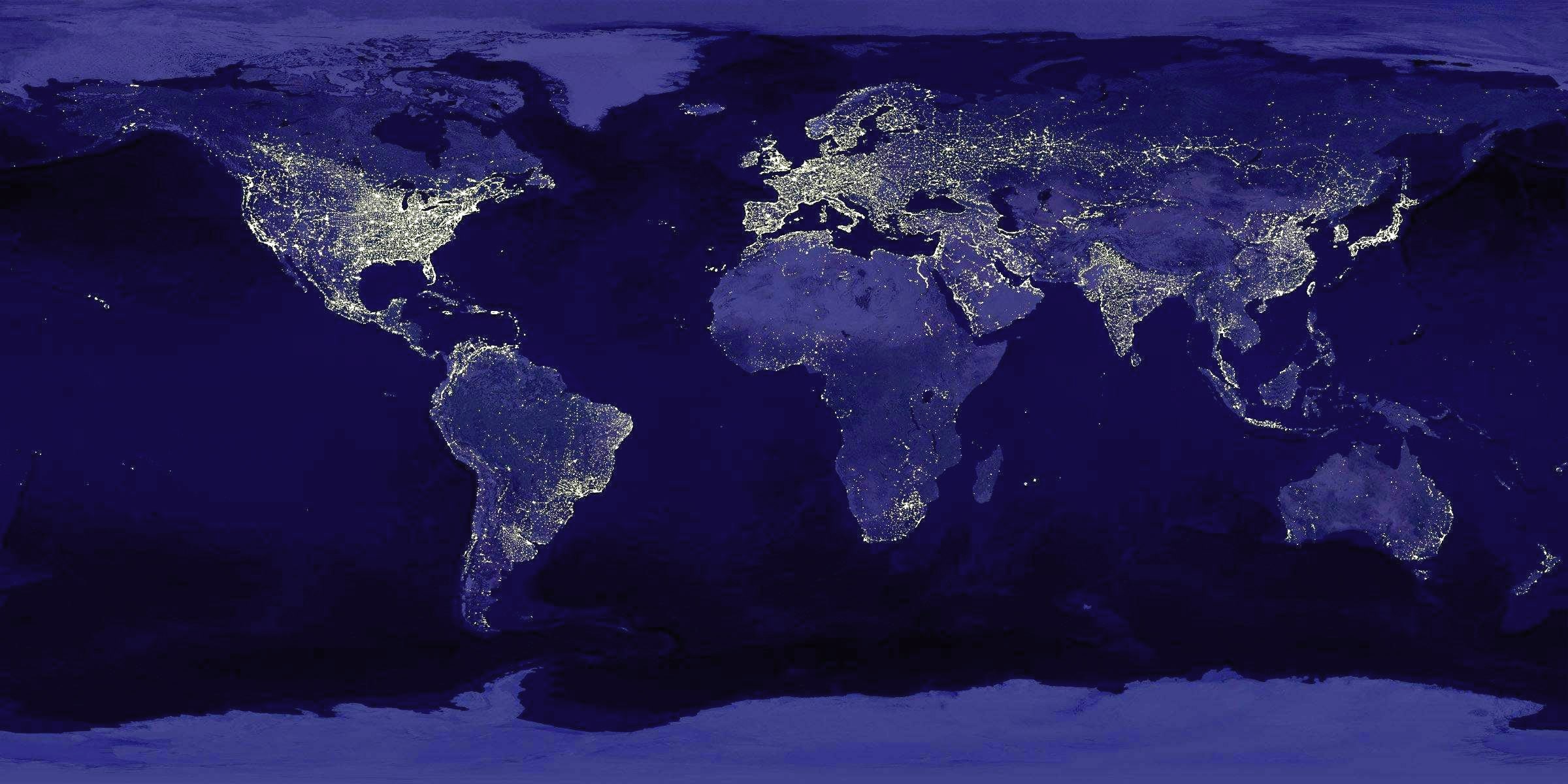

Protect your B2B transactions worldwide with Atradius trade credit insurance. Expand coverage to 130+ countries and ensure secure digital trade.

Atradius, one of the world’s biggest insurers of trade credit, significantly expands its single transaction cover solution to over 130 buyer countries, targeting an emerging industry of digital B2B platforms.

ZURICH / AMSTERDAM, 3 November 2021 The strategic cooperation between Atradius and Kemiex dates back to 2018, when the two companies co-developed an innovative trade credit insurance solution for the raw materials and chemicals trade platform operated by Kemiex. Single transaction cover insurance, or STCI, available via the platform, is an additional service for sellers of bulk volumes that do not have a more common annual whole-turnover-policy with a trade credit insurance company, or for countries and buyers that are not included in an existing policy. Enabled by smart algorithms and big data analytics, the new technology determines the insurance premium to cover proposed payment terms, allocates the capacity until a buyer confirms a transaction and manages post-trade procedures with the credit insurance. The extension of STCI to over 130 buyer countries strengthens the leadership of Atradius in serving an emerging segment of B2B platforms and data-driven business models. The digital credit insurance solution of Atradius is now also commercialised to other B2B marketplaces outside the chemicals sectors.

According to the latest reports by Dealroom, Adevinta Ventures and Speedinvest, there is an accelerating trend towards vertically integrated marketplaces that offer embedded Fintech and Insurtech solutions. Sources: The Future of Marketplaces 2021, The future of marketplaces: fintech-enabled

Credit insurance underwriting traditionally focuses on annual turnovers and a portfolio of buyers, as risk and balance-sheet management for large bulk transactions requires comprehensive knowledge and capital reserves. In Kemiex, most transactions between buyers, distributors and manufacturers are agreed for full container loads (FCL) with average volumes above 20’000 kg per transaction. To offer comparable efficiency benefits to Atradius clients with an existing annual policy, these companies can directly use their own existing policies to insure the transactions on the platform, with the same pricing and conditions. a novelty for the trade credit insurance industry.

- Rising demand from B2B marketplaces for embedded insurance, supply chain financing

- Single transaction (STCI) insurance now available for over 130 buyer countries

- Atradius and Kemiex co-developed the innovative solution to insure bulk transactions in 2018

ZURICH / AMSTERDAM, 3 November 2021 The strategic cooperation between Atradius and Kemiex dates back to 2018, when the two companies co-developed an innovative trade credit insurance solution for the raw materials and chemicals trade platform operated by Kemiex. Single transaction cover insurance, or STCI, available via the platform, is an additional service for sellers of bulk volumes that do not have a more common annual whole-turnover-policy with a trade credit insurance company, or for countries and buyers that are not included in an existing policy. Enabled by smart algorithms and big data analytics, the new technology determines the insurance premium to cover proposed payment terms, allocates the capacity until a buyer confirms a transaction and manages post-trade procedures with the credit insurance. The extension of STCI to over 130 buyer countries strengthens the leadership of Atradius in serving an emerging segment of B2B platforms and data-driven business models. The digital credit insurance solution of Atradius is now also commercialised to other B2B marketplaces outside the chemicals sectors.

According to the latest reports by Dealroom, Adevinta Ventures and Speedinvest, there is an accelerating trend towards vertically integrated marketplaces that offer embedded Fintech and Insurtech solutions. Sources: The Future of Marketplaces 2021, The future of marketplaces: fintech-enabled

Credit insurance underwriting traditionally focuses on annual turnovers and a portfolio of buyers, as risk and balance-sheet management for large bulk transactions requires comprehensive knowledge and capital reserves. In Kemiex, most transactions between buyers, distributors and manufacturers are agreed for full container loads (FCL) with average volumes above 20’000 kg per transaction. To offer comparable efficiency benefits to Atradius clients with an existing annual policy, these companies can directly use their own existing policies to insure the transactions on the platform, with the same pricing and conditions. a novelty for the trade credit insurance industry.

We have seen an increasing number and variety of digital platforms and B2B marketplaces seeking comprehensive trade credit insurance solutions for their ecosystems.Dirk Hagener, Director Group Communications and Commercial Development Atradius

Atradius has built an industry-leading credit insurance solution for professional trade platforms. We continue to invest into further enhancements to offer additional benefits to our Kemiex platform members.Pau Franquet, CEO of Kemiex

Atradius

Atradius is a global provider of credit insurance, surety and collection services, with a strategic presence in over 50 countries. The credit insurance, bond and collection products offered by Atradius protect companies around the world against the default risks associated with selling goods and services on credit. Atradius Crédito y Caución S.A. Seguros y Reaseguros (trade name Atradius) is a member of Grupo Catalana Occidente (GCO.MC), one of the largest insurers in Spain and one of the largest credit insurers in the world. You can find more information online at Atradius.com Contact: Olivier de Groot, Senior Manager Corporate Communications & Marketing, olivier.de.groot@atradius.comKemiex

The Zurich-based start-up is an awarded provider of digital trade and intelligence solutions for global buyers, traders and producers of raw materials and chemicals in human and animal nutrition and health industries. Next to its white-label portals for procurement and sales of raw materials, Kemiex operates the world’s first GDP-certified B2B marketplace for active pharmaceutical ingredients (API). Contact: Stefan Schmidinger, Head of Markets & Business Development, contact@kemiex.comRegister here for the virtual press conference on 17th November 2021, 11:00 am CET.