"Tougher times ahead?" asks Atradius latest Market Monitor for chemicals and healthcare ingredients sectors

Stay ahead with Atradius Market Monitor insights on chemicals and healthcare ingredients—analyze industry trends and global trade risks now.

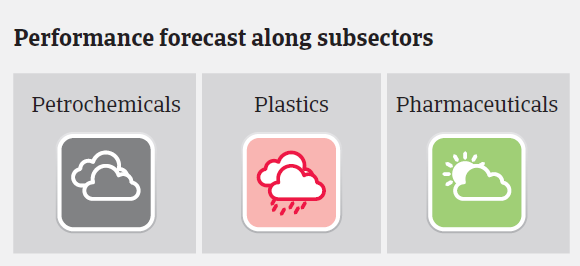

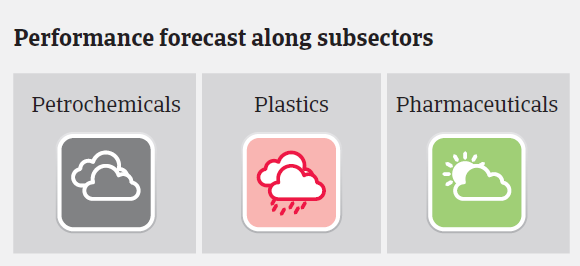

Globally, the chemicals industry has performed quite well over the last couple of years, with generally robust business financials, good payment records and low insolvency rates compared to other industries. The performance of the chemicals sector in all countries covered in this issue of the Market Monitor is still rated between ‘Good’ and ‘Fair’, but there seem to be tougher times ahead.

>> Download full Atradius Markext Monitor Report Chemicals 2019 <<

As the chemicals industry is cyclical and highly dependent on global economic performance, the ongoing insecurity over international trade issues has already left its mark. World trade growth stagnated in Q1 of 2019 amid escalating tariffs and ongoing uncertainty, and the expansion is forecast to slow to 2.0% in 2019, before recovering to a still-weak 2.8% in 2020.

The latest Market Monitor 2019 report unveils latest economics and payment practises for chemical and medicine ingredients sectors in 10 countries:

* China: repercussions of the Sino-US trade dispute are limited so far, payments take between 60 and 90 days on average, lending conditions remain very tight

* Italy: sluggish growth due to lower demand from key buyer industries, payments take 60 days on average, insolvencies expected to increase

* United States: Sino-US trade dispute has started to impact the industry, businesses continue to enjoy the cost advantage of shale gas, payments take between 30 and 90 days

* Brazil

* France

* Germany

* Japan

* Singapore

* Spain

* United Kingdom

.

.

China preview