EXCLUSIVE: coronavirus impact analysis for APIs, feed and food additives

Analyze the coronavirus supply chain impact on APIs and additives. Stay informed and mitigate disruptions with expert insights today.

Kemiex conducted a survey among 97 life sciences professionals about the impact of the coronavirus on ingredient trade as the spread of the dangerous new virus is accelerating further. Some governments and companies already imposed restrictions and first response measures.

As of today, the new coronavirus has sickened more than 2’800 people worldwide and killed at least 80 in China deepening fears about its supply chain impact in coming months. Latest numbers available here

Please report errors or additions to market@kemiex.com

Please report errors or additions to market@kemiex.com

DISCLAIMER / COPYRIGHT Content by Kemiex AG (“Kemiex”) is for informational purposes and for authorised members of its community only. Kemiex does not warrant that its market data reports are accurate or complete and hence, it should not be relied upon as such. The data is subject to change without any prior notice. Opinions expressed herein are our current opinions as on the date of this report. Nothing in this market data reports constitute purchasing, selling, trade, investment, legal, accounting or tax advice or any solicitation, whatsoever. Subscribers / readers assume the entire risk of any use made of this data. Kemiex clearly states that it has no financial liability whatsoever to the subscribers / readers of this report. All rights reserved. Any form of publication, reproduction, copying or disclosure of the content without clearly stating the source is not permitted.

Not yet a Kemiex client? Register here to join the largest professional network of buyers and sellers of APIs, feed and food additives.

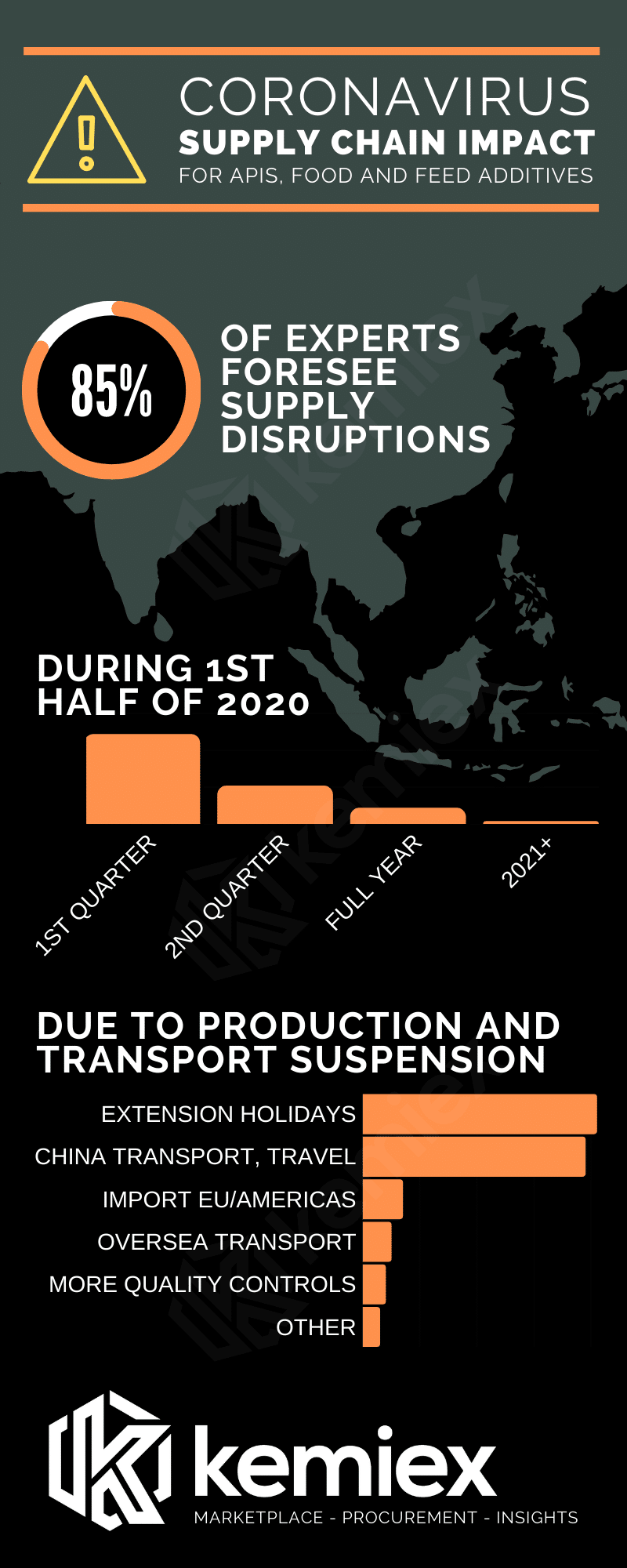

Survey shows 85% expect supply chain disruptions

A client survey among 97 professional buyers, traders and producers resulted in 34 respondents or 35% expecting a high, and 48 respondents or 50% a low impact on ingredient supply. Only 15 professionals, or 15%, expect no impact. Orders planned for the 1st quarter with delivery in 2nd quarter are expected to be mostly affected, while disruptions might continue a quarter. Only a minority believes the disruptions will last until year end or beyond 2020. The biggest impact is expected from extended Chinese New Year holidays and delayed production start, as seasonal maintenance and safety inspections seem to be affected too. Holidays were extended to Feb 9th by the government in Shanghai, Zhejiang, Jiangsu, Guangdong, Fujian and Chongqing. Some provinces, Hongkong and Taiwan are not affected or for shorter terms only. Government extended holidays until Feb 9th in most mainland areas: Anhui, Beijing, Chongqing, Fujian, Guangdong, Guizhou, Hebei, Heilongjiang, Henan, Hunan, Inner Mongolia, Jiangsu, Jiangxi, Jilin, Liaoning, Shaanxi, Shandong, Shanghai, Shanxi, Sichuan, Tianjin, Yunnan, Zhejiang excl. Wenzhou. Some factories there are not expected to return before February 17th. Holiday extension to Feb 13th and 17th in Hubei incl. Wuhan, and Wenzhou (Zhejiang) respectively. Shipping companies like Maersk and others informed about forced holiday extension and their business continuency plans for the safety of employees and customers. Situation reports are updated regularly by the World Health Organization and China’s National Health Commission. Some companies estimate not to return to markets before Feb 17th. Further restrictions are expected for inland transport and travel. It has been reported that selected non-Chinese manufacturers stopped offering, and that many industry professionals from China and elsewhere cancelled participation in exhibitions such as IPPE in Atlanta and upcoming food and feed additives fairs due to ongoing travel restrictions and contagion.

Not yet a Kemiex client? Register here to join the largest professional network of buyers and sellers of APIs, feed and food additives.

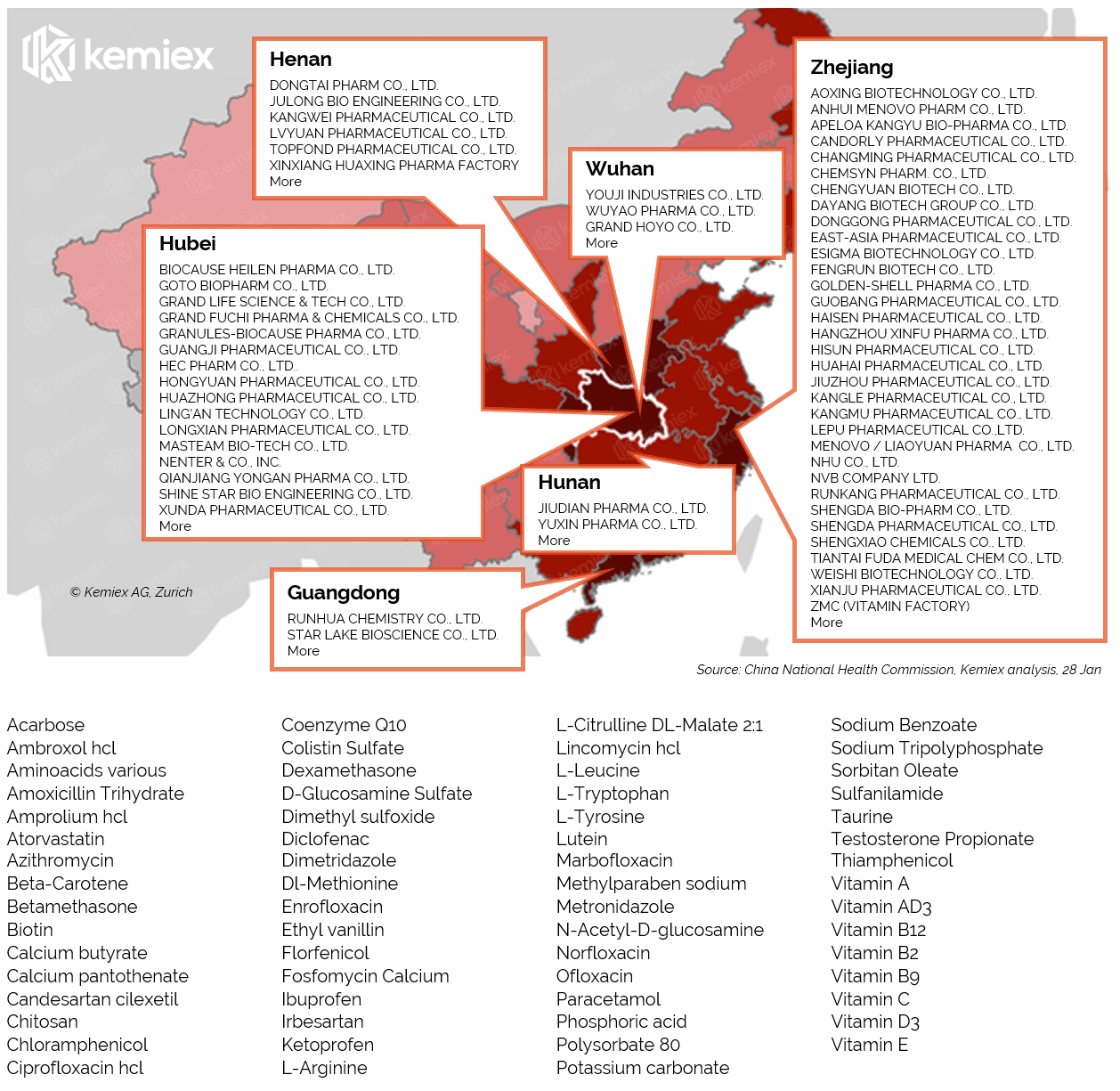

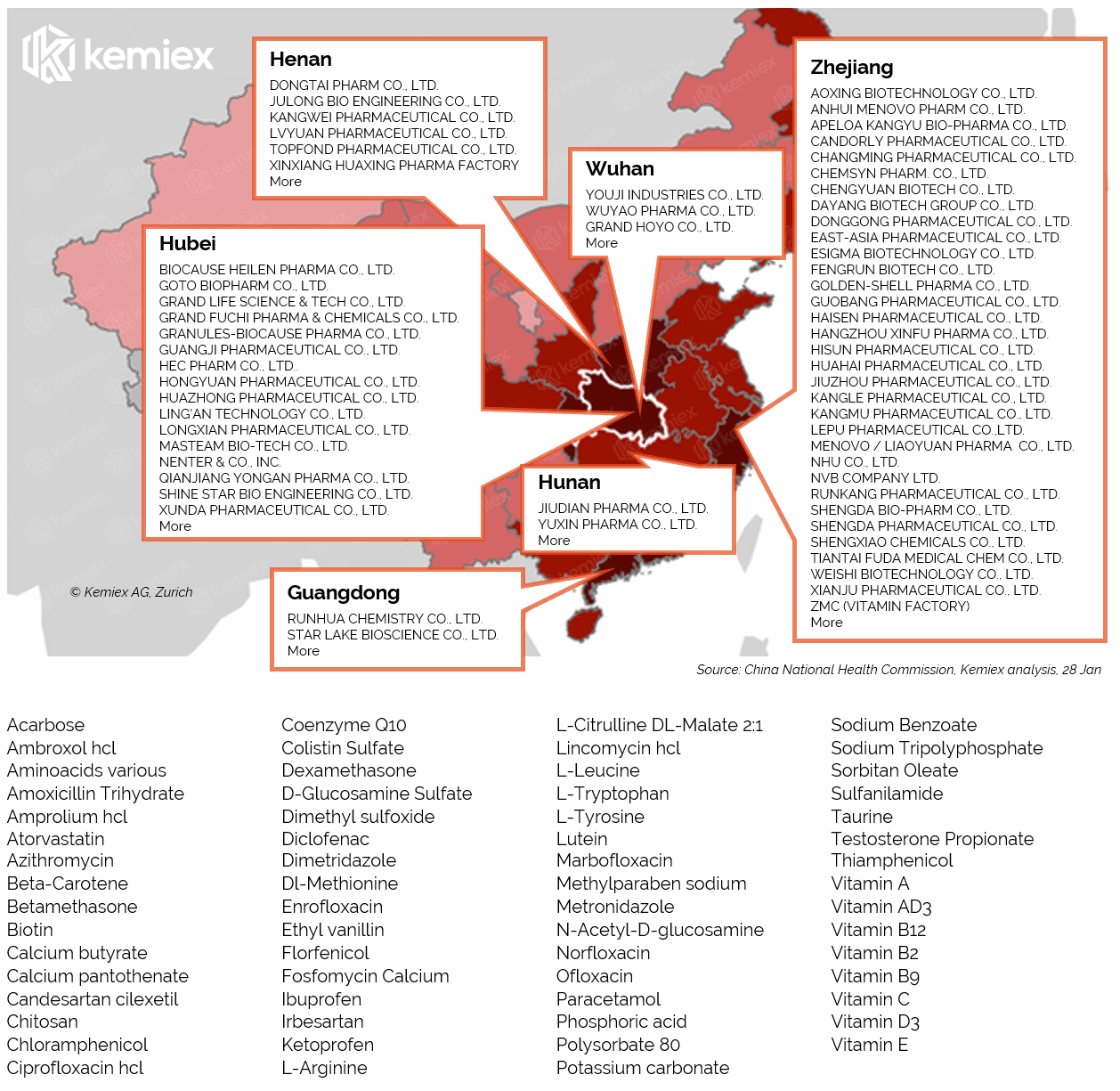

Most affected regions are home to important producers

A first impact analysis based on preliminary information shows that only selected products such as amino acids (taurine…), certain vitamins and other APIs and additives could be affected. As no official statements were issued by producers, also due to an ongoing holiday season, procurement professionals globally must rely on their own impact assessments. European and other suppliers report readiness and stocks to secure delivery to end users during interruptions in China, or some of its districts respectively. Below analysis shows an indicative and preliminary overview of producers and products located in the most affected regions. Please report errors or additions to market@kemiex.com

Please report errors or additions to market@kemiex.com

Not yet a Kemiex client? Register here to join the largest professional network of buyers and sellers of APIs, feed and food additives.

DISCLAIMER / COPYRIGHT Content by Kemiex AG (“Kemiex”) is for informational purposes and for authorised members of its community only. Kemiex does not warrant that its market data reports are accurate or complete and hence, it should not be relied upon as such. The data is subject to change without any prior notice. Opinions expressed herein are our current opinions as on the date of this report. Nothing in this market data reports constitute purchasing, selling, trade, investment, legal, accounting or tax advice or any solicitation, whatsoever. Subscribers / readers assume the entire risk of any use made of this data. Kemiex clearly states that it has no financial liability whatsoever to the subscribers / readers of this report. All rights reserved. Any form of publication, reproduction, copying or disclosure of the content without clearly stating the source is not permitted.