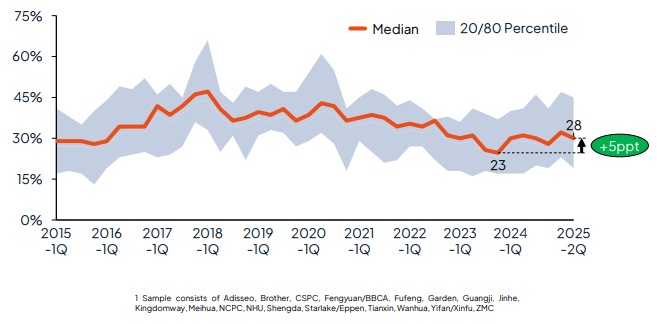

Gross profit margin evolution of major Chinese ingredients producers in 1H 2025

Ingredients producers post robust 1H 2025 financial results

Major ingredients producers published robust financial results for 1H 2025. With stronger top and bottom-lines for many companies year-on year, the industry has been resilient during a time marked by uncertainty and restructuring. However, lower prices for vitamins and amino acids could weigh on results in 2H 2025.

Companies reported risks from ever-changing tariff policy and uncertainty, anti-dumping cases, currency developments, and lackluster downstream demand.

Growth was attributed to a mix of increased volumes and favorable prices for select vitamins and amino acids. Some products saw mixed results, like L-Lysine with companies reporting substantial increases in sale volumes while others reported weaker prices offsetting marginal volume increases.

Vitamin firms noted robust demand leading to increased volumes, especially for Vitamin E, A, B5 and C. Companies also reported favorable prices for Vitamins B1 and B6.

Vitamins

- Brother reports +3.5% operating income

- CSPC’s Vitamin C revenue up +22%

- Guangji reduces losses

- Kingdomway doubles profit, driven by VA

- NHU increases Nutrition revenue by +8%

- Shengda grows operating income +4%

- Tianxin reports better revenue from VB1, B6

- Wanhua launches ‘Year of Change’ initiative

- Zhejiang Garden posts +14% profits

- ZMC’s Life Nutrition income up +1%

Amino Acids

- Adisseo reports +17% operating income

- Fufeng Lysine and Threonine revenue up +28%

- Golden Corn Lysine revenue falls -4%

- Huaheng operating income grows +47%

- Meihua amino acid revenue up +3.4%

Gross profit margin of select Chinese ingredients producers1 (%)

Download the full report or get in touch with our team for more information.

Stay ahead of market shifts with data you can trust.